Credit Repairs , Credit Correction , Credit rectification .

- Makarand Ambekar

- Apr 29, 2023

- 2 min read

Updated: Sep 5, 2023

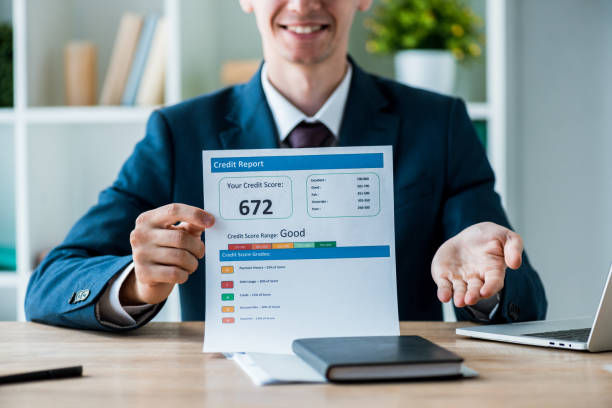

Credit repair refers to the process of improving one's credit scores and credit reports, typically by identifying and disputing inaccurate or outdated information on the reports. To repair credit, individuals may take the following steps: 1. Obtain a copy of your credit report from the major credit reporting bureaus. 2. Review the report carefully and identify any errors or inaccuracies. 3. Dispute any errors and provide documentation to support your dispute. 4. Pay off any outstanding debts or collections to improve your credit utilization ratio. 5. Make sure all bills are paid on time going forward. 6. Consider working with a reputable credit counseling agency or credit repair service. It's important to note that credit repair is not a guaranteed process and can take time to see improvement in scores. Also, be wary of any credit repair scams and do your research before hiring any company to help you improve your credit.

Credit correction refers to the process of identifying and correcting inaccuracies or errors in your credit report in order to improve your credit scores. There are several steps you can take to correct your credit, including: 1. Order a copy of your credit report from the three major credit reporting agencies (Equifax, Experian, and TransUnion) to review and identify any errors or inaccuracies. 2. Dispute any errors or inaccuracies with the credit reporting agency by submitting a dispute letter with supporting documentation. 3. Follow up with the credit reporting agency to ensure that the disputed information has been removed or corrected. 4. Pay down any outstanding debts and make sure that future payments are made on time. 5. Monitor your credit report on a regular basis to ensure that any errors or inaccuracies do not reappear. It's important to note that credit correction can take time and effort, but it can have a positive impact on your credit scores and financial health in the long run.

Credit rectification refers to the process of correcting or removing errors or inaccuracies from your credit report in order to improve your credit score. This can be done by taking certain steps, including: 1. Obtaining a copy of your credit report from one or all of the major credit bureaus (Equifax, Experian, and TransUnion). 2. Reviewing the report carefully for errors, such as incorrect personal information, accounts that do not belong to you, or accounts with incorrect balances or payment histories. 3. Disputing any errors with the credit bureau(s) by providing evidence to support your claim. 4. Checking your credit report regularly to ensure that any rectified errors have been corrected, and to catch any new inaccuracies that may appear. 5. Maintaining good credit habits, such as paying bills on time, using credit responsibly, and keeping credit card balances low, in order to build and maintain a good credit score over time.

Comments